IRS Notice CP80

It is critically important to know your rights before interacting with the IRS. San Diego Tax Attorney William D. Hartsock offers this advice.

Why did I receive a CP80 Notice or CP080 Notice from the IRS?

If you have received a CP80 Notice or CP080 Notice from the IRS, it is usually because the IRS is informing you that even though it has not received a tax return from you for the tax period indicated on the notice, it has made credits to your tax account, including crediting tax payments.

This could affect any Income Tax Audits & Appeals that you are involved in, as well as IRS Tax Litigation or Tax Collections actions.

Whenever you receive a CP80 Notice or CP080 Notice, you should:

- Read the CP80 Notice or CP080 Notice carefully, especially the amount of the credit the IRS has applied toward your tax account.

- If you filed a tax return for the year that is the subject of the CP80 Notice, attempt to determine why the IRS has no record of it and what you should do to ensure that the IRS receives a copy of the return as quickly as possible.

- If you did not file a return, determine whether you have a filing obligation for the year in question. If you’re not sure whether you have a filing obligation or not, consult a tax professional like the ones at www.TaxLawFirm.net who can also assist you in preparing the necessary return(s) if you feel you need such assistance.

- If you determine that you do not have a filing obligation for the year in question, determine whether the costs associated with filing a return are less than the amount of the credit you are entitled to receive as a refund.

- Determine whether you can or should request that the credit be applied to another tax form, tax period, or taxpayer identification number.

- Be sure to take action quickly so that you can make informed decisions and take all appropriate action before the applicable statute of limitations expires.

Answers to Frequently Asked Questions:

What should I do if I did file the tax return that the IRS says it never received?

Locate your copy of the return and any evidence of its transmission to the IRS, such as a receipt from the U.S. Post Office. Although the IRS may request that you submit a newly-signed and dated copy of the return to it, it may be wise to consult with a tax professional before doing so to evaluate whether doing this is necessary and/or prudent.

How long do I have to file a tax return claiming a refund?

Generally, in order to receive a refund, you must file a tax return within three years of the date (including extensions) the return requesting a refund was due. The IRS will not issue refunds for tax returns that are filed more than three years after they were due.

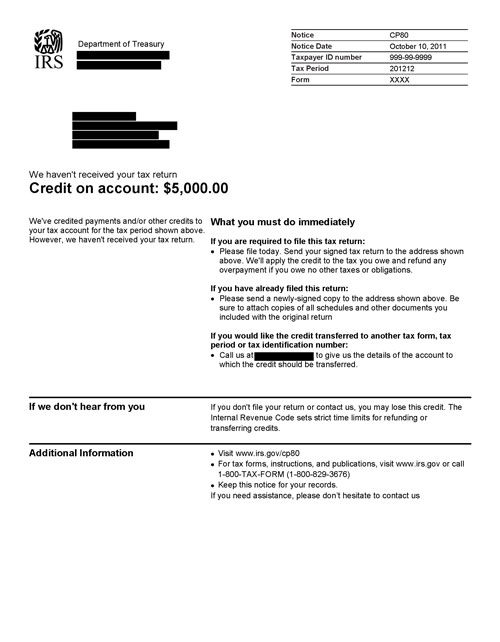

The following images are an example of what an IRS Tax Notice CP80 actually looks like.

This sample notice is for example purposes only. The case facts and figures on your notice will vary according to the specifics of your case.

Comments (0)