IRS Notice CP39

It is critical to know your rights before turning any information over to the IRS. San Diego Tax Attorney William D. Hartsock offers this advice.

Why did I receive a CP39 Notice from the IRS?

If you have received a CP39 Notice from the IRS, it is usually because the IRS is informing you that it applied a refund owed to your spouse or former spouse towards your past due tax debt. The notice will usually also advise you how much tax you still owe, if any.

This could affect any Innocent Spouse, Separation of Joint & Several Liability that you are involved in, as well as IRS Tax Litigation or Tax Collections actions.

Whenever you receive a CP39 Notice, you should:

- Read the CP39 Notice carefully, especially the portion describing the amount of your spouse or former spouse’s refund that the IRS applied to your past due tax debt.

- If you do not believe your former spouse is not responsible for your tax debt and that the portion of his or her refund that the IRS applied toward your debt was in error, contact a tax professional like the ones at www.TaxLawFirm.net for guidance on what to do, and if you should take any action, how to make this known to the IRS in a way that is the least likely to spark further inquiry by the IRS. In addition to doing what is right or decent, attempting to absolve your former spouse from responsibility for a tax debt you believe is not his or her responsibility can have the additional benefit of discouraging your former spouse from providing the IRS with information about you that could spark further IRS inquiry about you.

- If you owe a past due tax debt, pay it in full by the date specified in the notice to avoid incurring additional interest and penalties. If you cannot pay the full amount by the date specified in the notice, contact a tax professional like the ones at www.TaxLawFirm.net for assistance in working out a payment plan with the IRS.

Answers to Frequently Asked Tax Law Questions:

If I am not able to pay the full amount of tax I owe by the due date, will the amount of my tax obligation increase?

Interest will accrue on an unpaid tax balance beginning on the day after the tax is due. Also, you will be assessed a late payment penalty if the full amount of tax you owe is not paid on the day it is due. With respect to both interest and penalties, the due date is the last date on which you could file the tax return that is at issue, including extension requests.

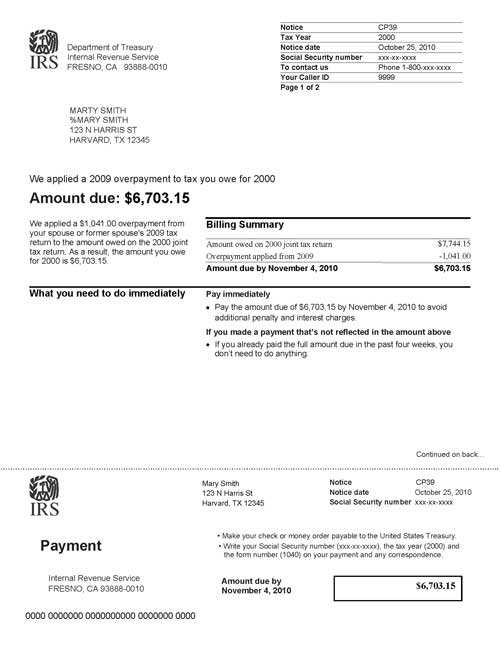

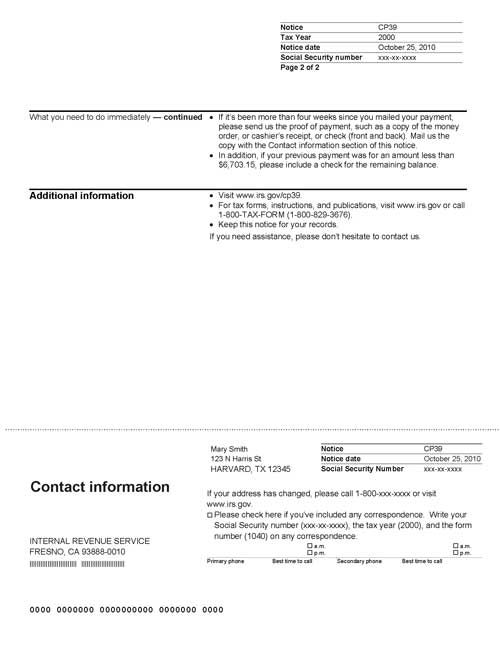

The following images are an example of what an IRS Tax Notice CP39 actually looks like.

This sample notice is for example purposes only. The case facts and figures on your notice will vary according to the specifics of your case.

Comments (0)