IRS Notice CP19

It is critical to know your rights before turning any information over to the IRS. San Diego Tax Attorney William D. Hartsock offers this advice.

Why did I receive a CP19 Notice from the IRS?

If you have received a CP19 Notice from the IRS, it is usually because the IRS believes you claimed one or more deductions and/or credits on your federal income tax return that you shouldn’t have. As a result, the IRS made adjustments to your return that increased the amount of tax you owe. A response form is usually included with or as part of a CP19 Notice, along with a request that the taxpayer(s) fill the form out, sign it, and return it to the IRS within 30 days of the date of the notice.

This could affect any Income Tax Audits & Appeals that you are involved in, as well as IRS Tax Litigation or Tax Collections actions.

Whenever you receive a CP19 Notice, you should:

- Read the CP19 Notice carefully, especially all parts of the notice where the IRS identifies what deduction(s) and/or credit(s) it believes you claimed improperly and what changes it made to your return. Then review the relevant portion(s) of your tax return for any signs of an obvious mistake on the return you filed.

- Even if, after reviewing your tax return, you agree with the adjustments the IRS made to your return and its revised amounts, it is still a very wise idea to discuss the matter with a tax law professional before you fill out, sign, and return the response form enclosed with the CP19 Notice. Signing and returning a response form without first undergoing a careful analysis of the underlying issue and any related matters can be a serious trap for the unwary. Time is of essence in terms of your response to a CP19 Notice. Because interest will increase and additional penalties may apply if you do not provide the IRS with a written response to the CP19 Notice within 30 days, it is extremely important that you seek legal advice quickly after receiving the notice.

- If, after reviewing your tax return, you do not agree with the adjustments the IRS made to your return, it is also usually very prudent to consult a tax professional before you fill out, sign, and return the enclosed response form indicating your disagreement. The IRS usually asks the taxpayer to whom it sends a CP19 Notice to provide documentation supporting the taxpayer’s position that a return was correct as filed. A response that is carefully prepared by a tax law professional like the ones at www.TaxLawFirm.net that provides appropriate supporting documentation and nothing more can often mean the difference between quick resolution and a drawn out audit that leads to additional areas of inquiry.

Answers to Frequently Asked Questions:

Why is the IRS reviewing my return?

While most returns are accepted by the IRS as filed, a certain number of returns are selected for examination. The IRS examines some income tax returns to verify that the income, expenses, and credits reported on the return are accurate. The IRS selects tax returns for examination using various methods including random sampling, computerized screening, and comparing information the IRS has received that relates to the return, such as W-2 and 1099 forms. Just because your tax return was selected for examination does necessarily mean that the IRS believes you made an error or were dishonest on your return.

If I am not able to pay the full amount of tax I owe by the due date, will the amount of my tax obligation increase?

Interest will accrue on an unpaid tax balance beginning on the day after the tax is due. Also, you will be assessed a late payment penalty if the full amount of tax you owe is not paid on the day it is due. With respect to both interest and penalties, the due date is the last date on which you could file the tax return that is at issue, including extension requests.

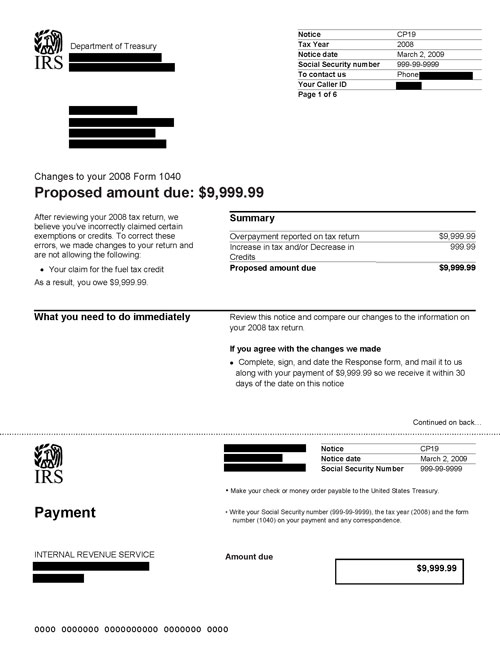

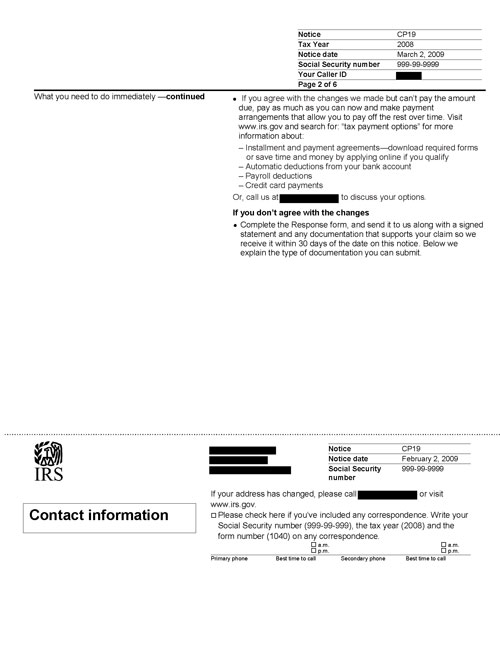

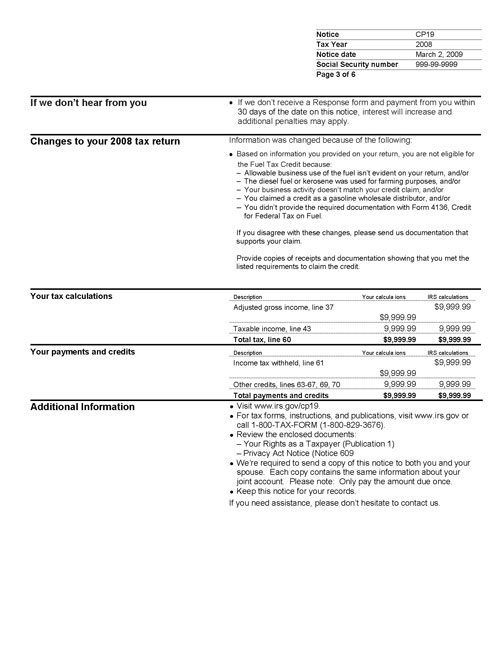

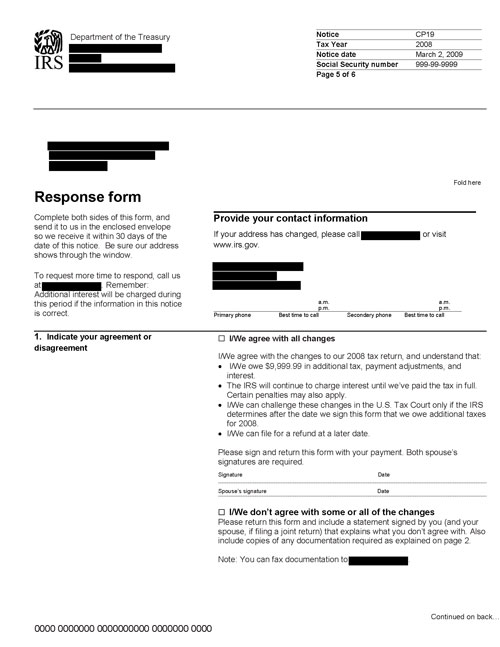

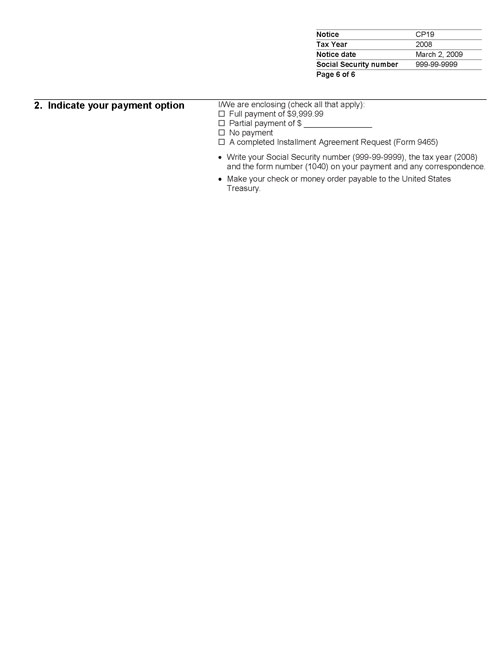

The following images are an example of what an IRS Tax Notice CP19 actually looks like.

This sample notice is for example purposes only. The case facts and figures on your notice will vary according to the specifics of your case.

Comments (0)