IRS Notice CP14

It is critical to know your rights before turning any information over to the IRS or responding to IRS nocice CP12E. San Diego Tax Attorney William D. Hartsock offers this advice.

Why did I receive a CP12E Notice from the IRS?

If you have received a CP12E Notice from the IRS, it usually means the following: (1) that the IRS believes there was one or more miscalculations on your tax return, (2) that the IRS has made changes to your return as a result of the miscalculation(s), and (3) that the amount of tax you overpaid is different than what is reflected on the tax return you filed. The overpayment means that either your refund will be larger than you anticipated, or that the amount you asked be applied to the current year’s taxes will be more than you expected. This could affect any Income Tax Audits & Appeals that you are involved in, as well as IRS Tax Litigation or Tax Collections actions.

Whenever you receive a CP12E Notice, you should:

- Read the CP12E Notice carefully, especially: (1) the part that explains why the IRS believes there was a miscalculation on your tax return and the changes that the IRS has made to your return; and (2) the part describing any additional steps you need to take.

- If you agree with the IRS’s explanation and the corrections it has made to your tax return, (1) make these corrections on the copy of your tax return that you kept, and (2) if you requested that taxes you overpaid for last year be applied to your tax obligations for this year, make any necessary adjustments to your tax withholding or estimated tax payments in order to avoid significantly overpaying your taxes for this year.

- If you do NOT agree with the IRS’s explanation and/or the corrections it has made to your tax return, contact a Tax Attorney such as the ones at www.TaxLawFirm.net to discuss the best strategy for resolving the discrepancy with the IRS. Be sure to contact a tax law professional right away, because the IRS must generally be advised in writing about a discrepancy within 60 days of the date on the CP12E Notice you received. If the discrepancy is not addressed properly, your tax return could be referred for audit.

Answers to Frequently Asked Questions:

Why is the IRS reviewing my return?

While most returns are accepted by the IRS as filed, a certain number of returns are selected for examination. The IRS examines some income tax returns to verify that the income, expenses, and credits reported on the return are accurate. The IRS selects tax returns for examination using various methods including random sampling, computerized screening, and comparing information the IRS has received that relates to the return, such as W-2 and 1099 forms. Just because your tax return was selected for examination does necessarily mean that the IRS believes you made an error or were dishonest on your return.

How do I adjust my estimated tax payments?

If you are an employee, you generally make estimated tax payments through the amount of federal income withheld pursuant to the Form W-4 on file with your employer. If you need to make an adjustment to the amount that is withheld from your pay, submit a new Form W-4 to your employer. If you are self-employed, you generally make estimated tax payments by submitting payment four times a year along with a completed Form 1040-ES. Consult IRS Publication 505, Tax Withholding and Estimated Tax, for a good overview discussion on how to calculate withholding and estimated tax.

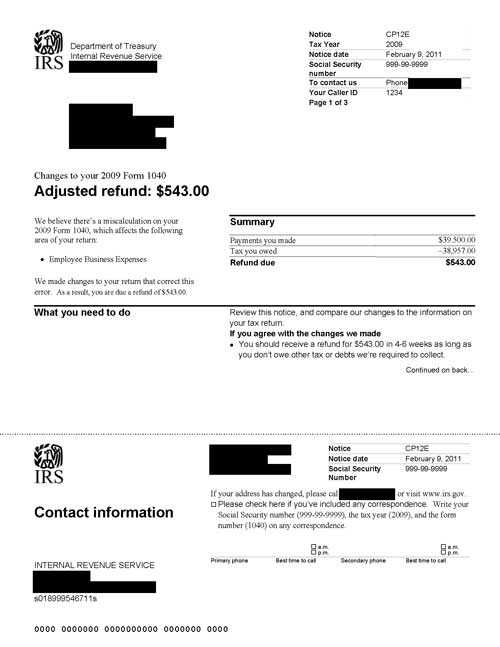

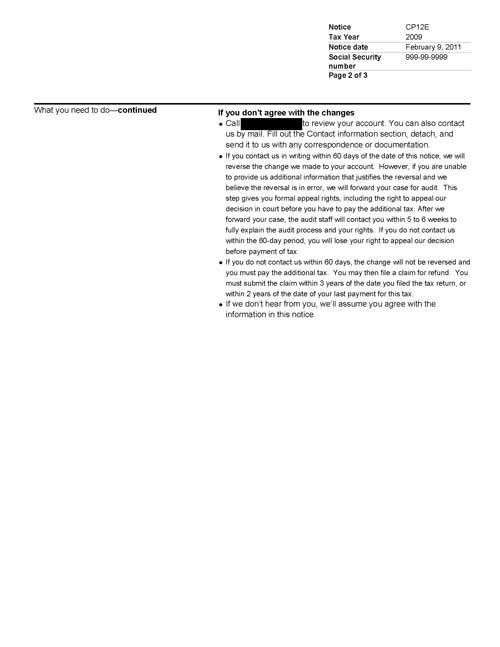

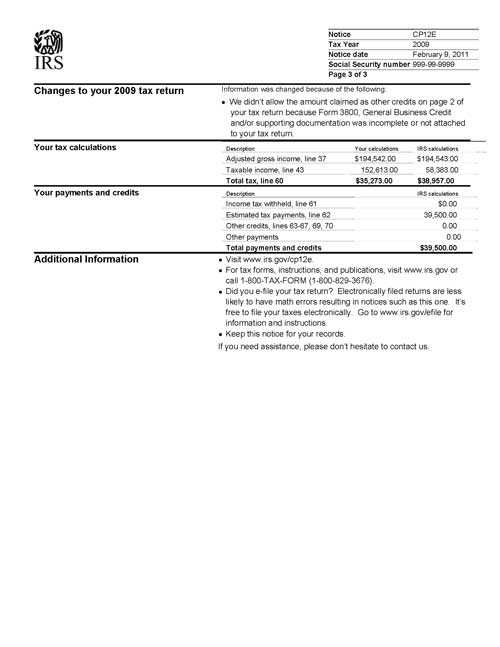

The following images are an example of what an IRS Tax Notice CP12E actually looks like.

This sample notice is for example purposes only. The case facts and figures on your notice will vary according to the specifics of your case.

Comments (0)